Banks and moneylending: habits of borrowing in the Grand Duchy of Lithuania

Large credits and large banks could emerge only in those societies, which developed exchange, consumption and cash circulation. Such societies were being creating slowly in the Middle Ages. Then private individuals and merchants rather than enterprises that most often engaged in credits. They lent unsystematically and comparatively small amounts. However, even societies of a low economic level could not survive without the possibility of borrowing, and lenders expected to receive reward for their good deed – interest. What size did interest have to be? That was a moral issue, which religious leaders tried to elucidate almost everywhere. Christians looked at moneylending and taking interest negatively, though they admitted the necessity of the credit. The church agreed that monthly 1% interest (12.7% per year) was fair enough. A higher interest rate was regarded as usury. Since the society needed credits, the Jews were pushed into this business because their faith forbade them to engage in agriculture and crafts. In the 14th – 16th centuries, when international exchange intensified and mining of precious metals increased, crediting became more systematic, and the people engaged in crediting started to unite into larger companies. Moral attitudes of the Europeans towards the interest rate also changed: businesspeople received approval from the statesmen more and more often that the interest rate received from investment business was not usury. In the course of the 17th century the state became engaged in crediting matters to a greater extent and banks became more stable: in 1609, the bank in Amsterdam became an institution, which had a building, and in 1694, the state (central) Bank of England was established in London, which was the prototype of the modern banks.

The utopia of the interest-free credits

In the Middle Ages and in the early modern ages Lithuania was not a country of either large exchanges or high consumption (large cities). The crediting system never manifested itself strongly. In 1584, the idea emerged in the Palace of Stephen Báthory to create the foundation in the GDL from the income derived from the taxes of the nobility’s peasants and the royal mint, which would grant credits with interest rates as low as 10 per cent per year but this project remained on paper only. It is not surprising because such a state bank had to face the local credit providers who had been established in the market a long time ago, as well as the foreign ones. Hence, during the entire period of the existence of the Grand Duchy of Lithuania private lenders prevailed in the market, and the rules of the game were dictated by large foreign players.

As far back as the beginning of the 14th century the Lithuanians used crediting structures created by the westerners and did not create any new credit institutions or mechanisms.

The Rulers and larger merchants made use of the credit of the foreign merchants. Fraternities of craftsmen, which were often accused of usury, had a greater crediting significance in the cities. In 1579, as a counterbalance to them, Piotr Skarga (later he became Rector of Vilnius University) established Mons Pietatis (word by word translation means the mountain of fear of God). That was a peculiar crediting fund, which lent money voluntarily brought by the benefactors, for a symbolic pledge (forfeit). The first Mons Pietatis were established by the Franciscans in France in the 15th century. Practice of their activity showed that even without seeking to get profit Mons Pietatis could not lend money without surcharge payments covering the administration costs. Therefore, the debtors were demanded to pay 5% interest. It seems that under such conditions this crediting organisation operated in Lithuania too.

The debt note that turned into a contract with the devil

The Jews were typical large and small lenders all over Europe. Lithuania took over European experience: as far back as the end of the 14th century Vytautas allowed Jewish communities to be established in some towns. Vytautas’ privilege for the Jews of Brest writes: “A Jew also can take any thing brought to him as a pledge, no matter what that thing is called, asking nothing about it, with the exception of blood-stained and wet clothes and church clothes, as well as dishes, which he cannot take by any means”. The Jewish communities, which had self-governance, were networks of accumulating funds necessary for crediting. This gave rise to the wrong understanding that every Jew was a moneylender.

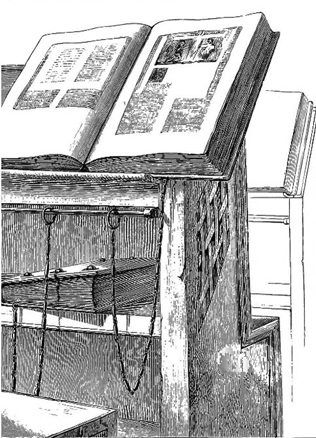

We can speak a lot about contracts between the merchants of the Grand Duchy of Lithuania and foreign merchants. Every case, however, requires going deeper into it. Thus, Hans Lamburg, one of the best money lenders in Königsberg, introduced himself as a subordinate of the Grand Duchy of Lithuania at the end of the 15th century. He used debt notes in his practice – the type of chirographies (Lat. chirographum). Two texts testifying to the debt were written on that note. After that the note was cut in halves and the authenticity of the debt was verified after the creditor and the borrower had brought together their parts of the contract. After the debt had been paid back, the borrower got back the second part of the chirograph from the creditor and destroyed it. Such documents are often mentioned in Lithuania in the 16th century (цирокграф). Later the chirograph became a synonym of the contract with the devil.

Do You Know?

Chirograph (Lat. chirographum) is a sheet on which two texts testifying to the debt were written on that note. After that the sheet had been cut in halves the creditor and the borrower received a half thereof and after the debt had been paid back, the borrower got back the second part of the chirograph from the creditor and destroyed it. Such documents are often mentioned in Lithuania in the 16th century (цирокграф). The medieval attitude to money borrowing is testified to by the fact that later the chirograph became a synonym of the contract with the devil.

Meanwhile the Jews (especially in the 18th century) most often legalised the credit during the fairs by mamrans (ממדנ״י, ממדם, ממדן), i.e. bills of exchange. The name of this document is derived from the Latin word membranum – leather, parchment, a sheet of writing. In the Jewish tradition such a sheet was filled in on both sides: the amount of debt was indicated on one side and the name (signature) of the creditor, as well as the names of witnesses, was written on the other side. After the payment this document did not necessarily have to be destroyed. It could be rewritten for another person. Neither the reasons for the debt nor the place of paying back the debt was indicated in the mamran. Its holder could put claims to the debtor at any time. Later the so-called blank or open mamrans appeared – an undersigned debt contract with unfilled in places in the text “windows” in which the amount of the debt and the place of paying it back had to be written. Mamrans (мамранъ, mamran) became popular on the farms of Lithuanian nobility. From the middle of the 16th century, with the nobility being constantly short of money, one of the “most sacred” duties of the Ruler’s servitors was to find a credit. To make the servitors legalise the debt sooner the nobleman gave him a batch of undersigned but not filled in mamrans.

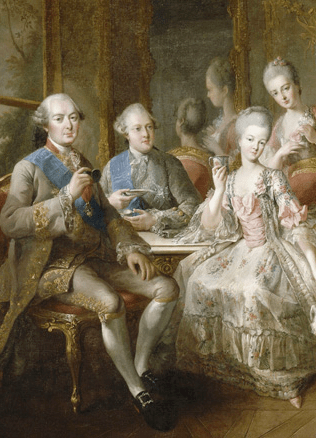

Business adventures of the noblemen

Unlike the majority of European countries, from the middle of the 16th century the noblemen of the Grand Duchy of Lithuania and the Kingdom of Poland became involved in trade relations. It was they who were large businesspeople of that time. There is no need to wonder that the documents reflecting their economic activity of that period contained many concepts of economics: capital, interest, credit. Economic treatises were devoted to the nobility, for example, Marcin Smigliecki’s work On interest rate published in Vilnius in 1596.

Typical legalisation of the nobleman’s credit was made after the immovable property had been mortgaged and the mortgage sheet (застава, заставнои лист) had been properly written.

This fashion was dictated by the Ruler’s court. For example, in 1563 Sigismund Augustus mortgaged the small rural districts of Palanga, Kretinga and Gargždai to one merchant from Gdansk for 50 000 thalers. The creditor received especially large profit from such transactions because before the debtor had paid back the credit, the creditor could make use of the taxes of the mortgaged property, in this case those of the said three small rural districts. After the right of the nobility to dispose of their land without restrictions was established in the Second Statute of Lithuania (1566) the nobility started to borrow more frequently and larger amounts. For example, the inventory of the property of an ordinary nobleman of Samogitia Jan Matawicz lists 27 persons who had given him debt and mortgage letters totalling more than 250 threescore grosz.

The noblemen used even larger sums. In 1574, the Count Jan Chodkiewisz of Shklov and Misha promised Wojtech Rudenski to pay back 1 000 threescore Lithuanian grosz by 1575 and “interest or the payment of a hundred grosz for the past seventy-fourth year”. In case he failed to do that by the said date, he promised to give to the creditor, until the debt was paid back, 10 volok of land belonging to the Misha estate. Hence, at first the credit was not secured by the mortgaged property, and the annual interest rate accounted for 10%. It turned out that it was not easy to fulfil the conditions of the credit; the debt was not paid back on time, and the immovable property was not handed over to the creditor. Upon the death of the debtor, his widow paid back the debt in 1586 only. After the long-lasting negotiations the debt was paid back in three instalments, 400 threescore each (including 200 threescore interest), adding to the money 10 measures of honey (медниц меду) with each payment. The creditor received interest together with the money lent not for 10 but for 2 years. Even in those days it was possible to decrease the interest rates, and after non-monetary gifts were introduced alongside the cash, the real interest rate was possible to conceal.

Literatūra: S. C. Rowell, Vokiečių ordino archyvo smulkmenos, arba kas XV a. Prūsuose vokiečių ordino didžiajam magistrui skolindavo pinigus?, Praeities pėdsakais. Skirta profesoriaus daktaro Zigmanto Kiaupos 65-mečiui, Vilnius, 2007, p. 337–348; Документы и регесты к истории литовских евреев (1388–1550), собрал С. Бершадский, С. Петербург, 1882, p. 6.

Eugenijus Saviščevas